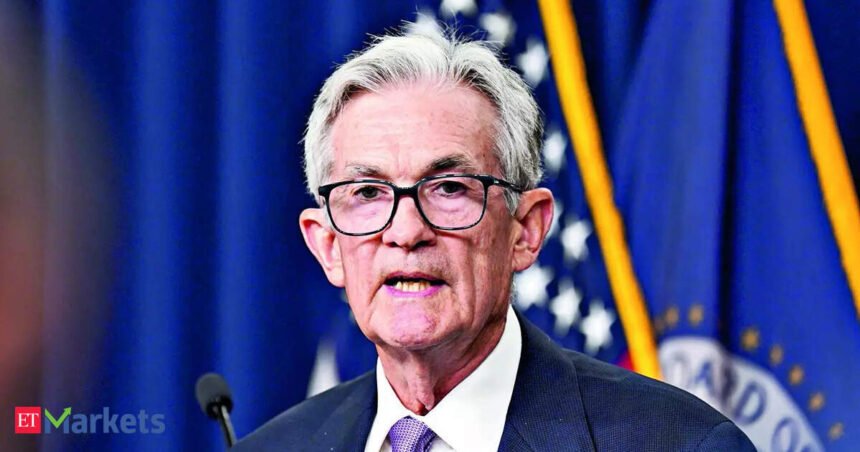

Powell held back from explicitly endorsing a reduction in borrowing costs at the Fed’s next meeting in September. But his emphasis on the prospects of a weakening economic backdrop made clear that a cut is likely next month.

“The balance of risks appears to be shifting,” Powell said in his final speech as Fed chair at an annual conference hosted by the Reserve Bank of Kansas City in Jackson, Wyoming. With borrowing costs weighing on the economy, the labor market softening and inflation risks contained, “the shifting balance of risks may warrant adjusting our policy stance,” said the chair.

Powell highlighted the recent slowdown in monthly jobs growth, but questioned whether it was a function of a pullback in demand from companies or a reduction in the supply of workers resulting from President Donald Trump’s immigration crackdown. He said that left the labour market in a “curious kind of balance” that warranted caution.

“This unusual situation suggests that downside risks to employment are rising,” he said. “And if those risks materialise, they can do so quickly in the form of sharply higher layoffs and rising unemployment.”

Powell stressed, however, that inflation was still too high even as he sought to push back on concerns that Trump’s tariffs would lead to a persistent rise in price pressures. Rather he said a “reasonable base case is that the effects will be relatively short-lived – a one-time shift in the price level.””Of course, ‘one-time’ does not mean ‘all at once.’ It will continue to take time for tariff increases to work their way through supply chains and distribution networks,” he added.Still, Powell acknowledged that the Fed was in a “challenging situation” given that the central bank’s two goals of low, stable inflation and a healthy labor market are now in tension with one another. Against this backdrop, he said, the Fed would need to “proceed carefully” with its plans to reduce the degree of restraint it is imposing on the economy.That suggests that once the Fed starts cutting, it will not reduce interest rates quickly or by much if the economy evolves as expected. Powell reiterated Friday that he viewed the central bank’s policy settings as only “modestly” restrictive, meaning there is not too far to go in terms of interest rate reductions before hitting the Fed’s desired level. The central bank is aiming for a “neutral” setting that neither revs up the economy nor slows it down.

Powell’s speech is typically the top billing of the three-day gathering, which brings together central bankers from around the world, current and past government officials and academics. Powell was met with resounding applause and a standing ovation before he began speaking.