Among the six large IPOs launched so far this year, four could be labelled blockbusters, getting subscribed in double digits – LG Electronics India (38.17 times), Lenskart Solutions (28.35 times), HDB Financial Services and Groww (17.6 times each). The response to Hexaware Technologies and Tata Capital was relatively muted at 2.27 times and 1.96 times, respectively. IPO market watchers said this has been driven by institutional investors flush with liquidity.

Agencies

Agencies Broad-based Demand

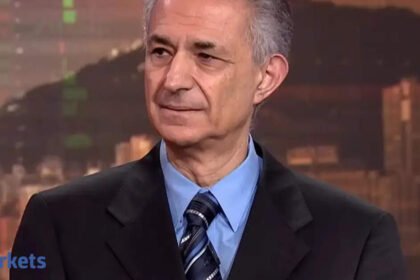

“The bulk of subscriptions, which is 75-80% of subscriptions, comes from institutions,” said Arun Kejriwal, founder, Kejriwal Research. “Then corporate treasury and bank treasury invest in the IPO. They exit on Day 1 of the listing.” 2021’s IPO bump was largely due to Nykaa-subscriptions at 81 times the shares on offer. The demand for IPOs has been broad-based this year.

Large issuances usually get lower subscriptions compared to the smaller ones, primarily because most struggle to deliver listing gains. One theory is that larger the supply of shares in a big-ticket issue–especially one priced steeply–less the chance of a listing pop.

This time, the demand for larger IPOs has also been higher because many of them, such as Tata Capital and HDB, were already trading in the unlisted market before the issues.

“That creates a reference price, and when it differs from the IPO price, it opens up short-term arbitrage opportunities for investors and encourages them to bid for IPOs,” said Kejriwal

Collectively, these six large IPOs in 2025 mobilised about Rs 62,000 crore. According to data collated by ETIG, in 2025 so far, 84 IPOs have raised a total of Rs 1.29 lakh crore.

“The IPO market is always a function of a bull market,” said Siddarth Bhamre, head, institutional research, Asit C Mehta. “When valuations are rich, liquidity turns towards the primary market. As more participants chase allocation, subscription numbers rise.”

THE SELECTIVE APROACH

Merchant bankers said the surge is fuelled by investors who prefer profitable, proven businesses over risky or untested ideas.

“The 2025 IPO cycle tells you that investor risk appetite hasn’t reduced, it’s become more intelligent,” said Amit Ramchandani, MD and CEO, Motilal Oswal Investment Advisors. “The ‘excesses’ phase has given way to selectivity: investors are willing to pay up for scale, profitability and brand-led growth, rather than narratives alone. What’s striking is that even large issues are seeing deep participation from both institutional and HNI segments, indicating that liquidity is being matched by discernment.”

In 2021, leaving aside Nykaa, other large issues like Paytm and Sona BLW Precision Forgings barely crossed two times subscription. In 2022, LIC‘s Rs 20,557 crore issue was subscribed 2.65 times, while Delhivery managed 1.33 times. 2023 did not see any IPOs with an issue size above Rs 5,000 crore. In 2024, the bull market helped drive investor demand in the IPOs of Bajaj Housing Finance (49.97 times) and Vishal Mega Mart (20.47 times).

“There is a strong shift in investor preferences for businesses with disruptive models,” said Bhavesh Shah, managing director and head, investment banking, Equirus Capital. “Investors don’t want to back me-too companies unless they are category leaders.”

While institutional investors still lead the demand for IPOs, retail participation has become more informed and consistent, Shah said.