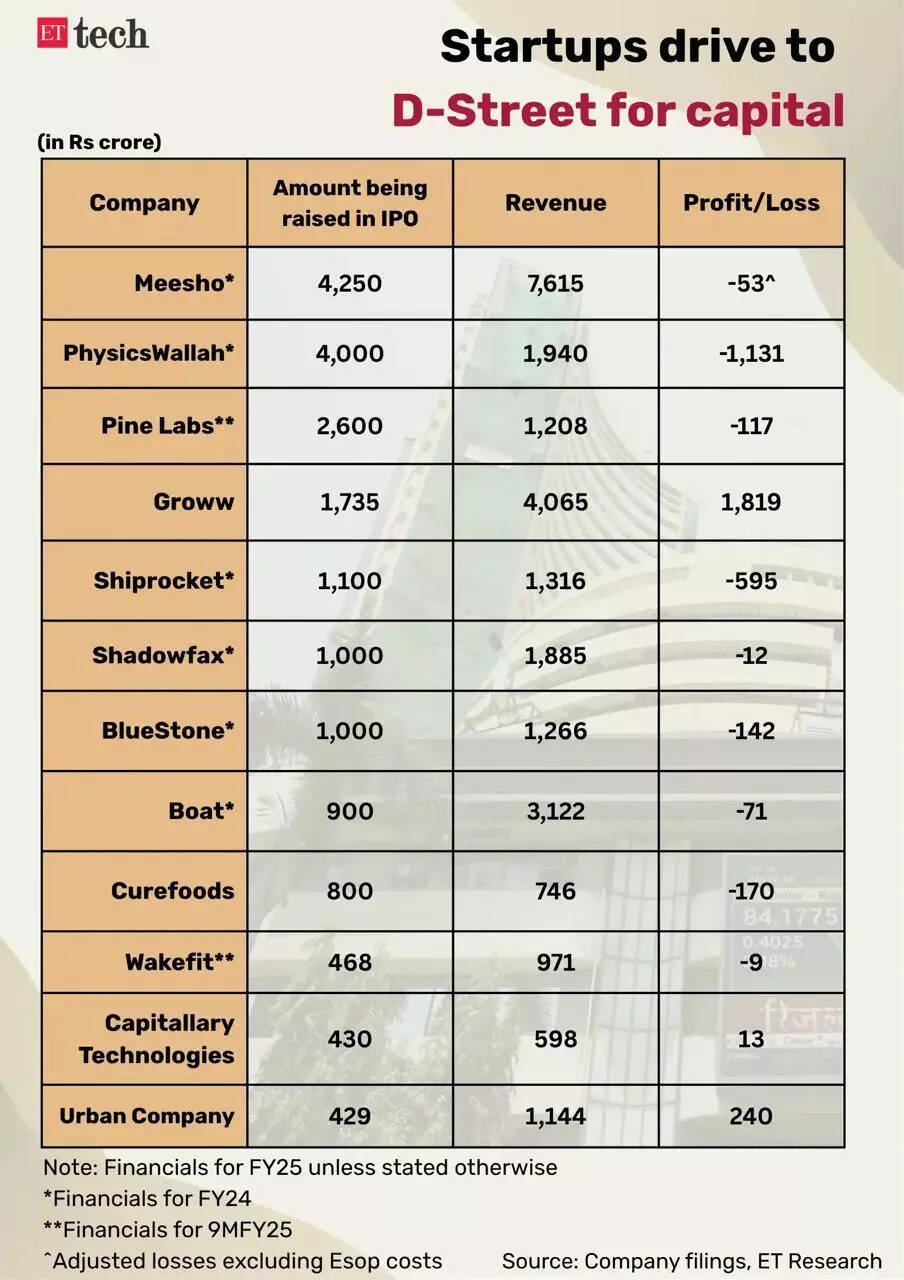

Omnichannel jewellery retailer BlueStone Jewellery & Lifestyle has reduced the size of its initial public offering (IPO) as per a revised red herring prospectus filed by the company. The Bengaluru-based company is now looking to raise Rs 820 crore in primary capital against Rs 1,000 crore that it had originally planned.

According to sources, the company is likely to go public at a valuation of around Rs 7,800 crore, which is less than its last private funding in August 2024, when it raised at a valuation of Rs 8,100 crore.

The offer-for-sale (OFS) component has also been shrunk to 13.9 million shares, compared to 24 million shares earlier – with investors including venture capital firms Accel, Kalaari Capital, Iron Pillar Fund and Hero group’s Sunil Kant Munjal planning to sell fewer shares than before. IvyCap Ventures, which was initially planning to sell 3.1 million shares, is not participating in the OFS now.

BlueStone, which received the Securities and Exchange Board of India’s approval in April, will launch its IPO on August 11, as per the prospectus.

ET reported in June that private wealth management firms 360 One and Centrum Wealth facilitated secondary deals amounting to Rs 300–350 crore in BlueStone.

Axis Capital, IIFL Capital and Kotak Mahindra are bankers to BlueStone’s issue.

BlueStone reported a 40% increase in operating revenue for fiscal 2025 to Rs 1,770 crore. Its net loss, however, expanded to Rs 222 crore in FY25 from Rs 142 crore in FY24.

Over the last few years, investors have turned bullish on the jewellery business. This trend picked up steam after the Tata Group’s full acquisition of CaratLane at a valuation of Rs 17,000 crore. The conglomerate had first invested in the startup in 2016, when it was valued at Rs 563 crore.

Omnichannel jewellery startup Giva, which specialises in silver products, is also in talks to pick up Rs 450 crore ($53 million) in a financing round led by Creaegis in addition to participation by Premji Invest, Epiq Capital and others.