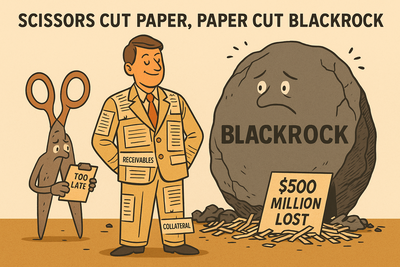

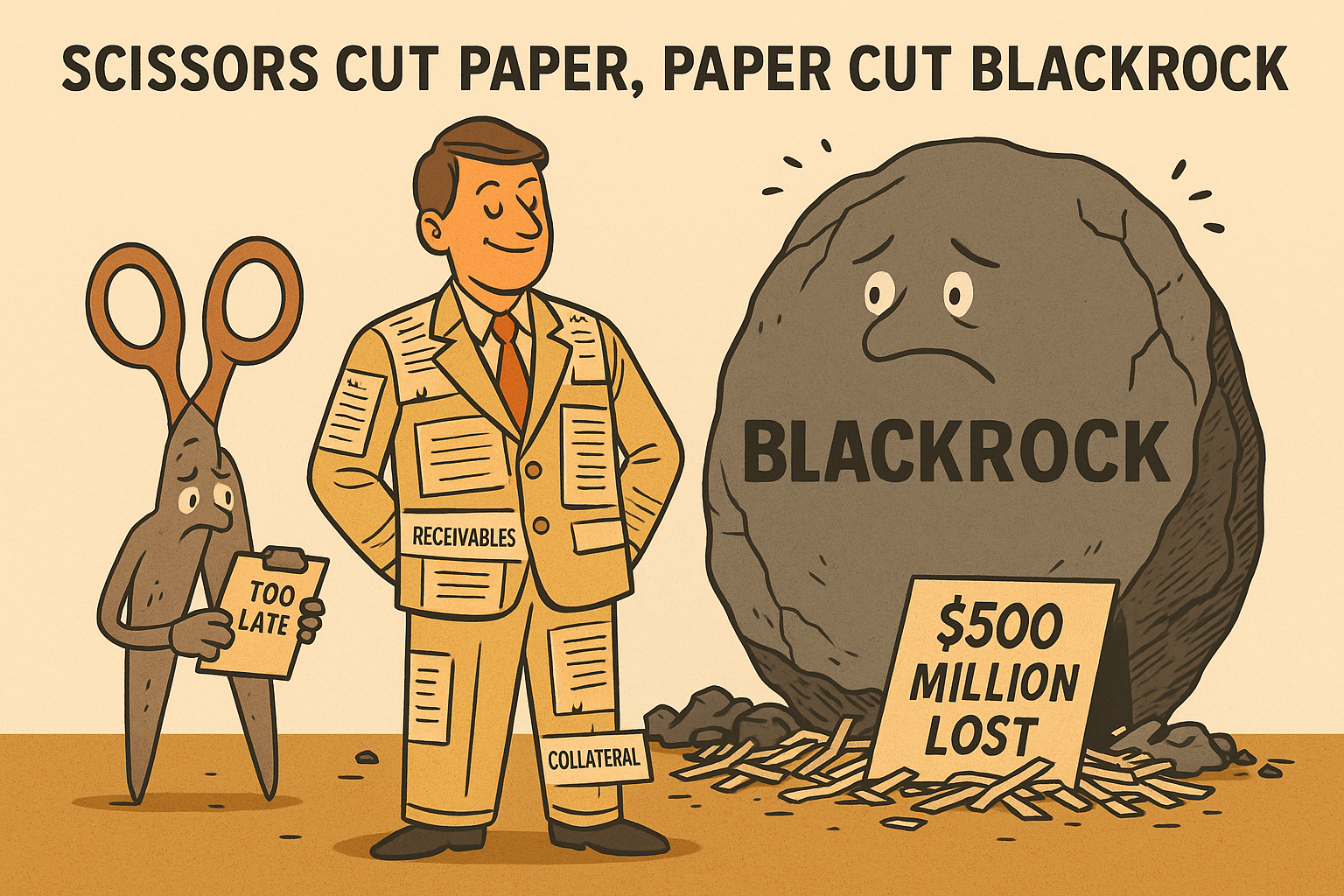

Imagine running a small telecom company and convincing the world’s biggest asset manager, BlackRock, that your business is booming. That’s what Indian-origin entrepreneur Bankim Brahmbhatt allegedly managed to do.Through his companies — Broadband Telecom, Bridgevoice, and Carriox Capital — Brahmbhatt borrowed more than $500 million from private-credit lenders led by HPS Investment Partners, a firm recently acquired by BlackRock. The collateral he offered sounded solid: accounts receivable, or money his companies were supposedly owed by customers.The problem? Those customers didn’t exist.According to court filings, nearly every invoice, email, and contract he provided was fake. He had built an empire on paper — complete with forged emails and invoices from imaginary telecom clients.

The Discovery: A Suspicious Email and a Locked Office

The scheme unravelled by accident.In July, an HPS employee noticed that some customer emails confirming Brahmbhatt’s invoices looked strange. They came from addresses like @bics-telecom.com instead of the real @bics.com. When auditors investigated, they found that every customer email used to verify invoices over the past two years was fake. Some of the supposed clients had never even heard of him.When lenders raised the issue, Brahmbhatt assured them there was “nothing to worry about” — then stopped answering calls.An investigator sent to his New York office found it locked and deserted. His nearby home was another scene out of a movie: two BMWs, a Porsche, a Tesla and an Audi parked neatly outside, and packages left unopened on the porch.

The Method: How the Fraud Worked

This wasn’t a classic Ponzi scheme or crypto scam. It was something quieter, hidden inside the machinery of modern finance. Brahmbhatt tapped into a system called asset-based lending, where loans are given against business income or customer payments. In theory, it’s low-risk. In practice, it’s easy to game.Here’s how Brahmbhatt did it:

- Fake customers: He invented telecom clients that didn’t exist.

Fake invoices : He created bills showing those clients owed millions.- Fake confirmations: He built lookalike domains and sent “proof” emails to lenders.

- Real money: He used the fake receivables to get real loans from HPS and BNP Paribas.

- Offshore transfers: Some pledged assets were quietly moved to accounts in India and Mauritius.

It was a symphony of forgery, spreadsheets, and confidence — the kind of scam that works best when no one expects it.

The Fallout: BlackRock’s $500 Million Lesson

When the truth came out, Brahmbhatt’s companies filed for bankruptcy in August. BNP Paribas, which helped fund the loans, added around $220 million to its loan-loss provisions. HPS told its investors that while the hit was painful, it wouldn’t threaten its $179 billion portfolio.Still, the embarrassment was enormous. The world’s most sophisticated asset manager had been duped by forged PDFs and fake emails.

The Bigger Picture: When Easy Money Meets Easy Lies

Private credit — lending by funds instead of banks — has exploded in recent years. It’s fast, profitable, and lightly regulated. But the Brahmbhatt case shows just how fragile it can be.Two other collapses this year, in the US auto industry, had already raised alarms. Companies like First Brands and Tricolor were accused of doing the same thing: inflating assets and pledging fiction as collateral. Brahmbhatt simply took that playbook global.This wasn’t a story about high finance. It was a story about trust — and how quickly it can be sold.

The Vanishing Act

As of now, Bankim Brahmbhatt’s whereabouts remain unclear. His lawyer says he denies any wrongdoing. HPS believes he’s in India. His personal bankruptcy, filed the same day as his companies’, adds a strange symmetry to the scandal — the man and his empire collapsing together.

In Simple Terms

- What happened? A telecom CEO faked invoices and customers to borrow $500 million.

- Who got fooled? BlackRock’s lending arm HPS Investment Partners and co-lender BNP Paribas.

- How was it caught? An analyst noticed suspicious customer emails.

- What’s the damage? Bankrupt companies, hundreds of millions in losses, and lawsuits.

Where is he now? Missing. It wasn’t a hacker or a rogue algorithm that fooled Wall Street this time. It was a man with a spreadsheet, a smile, and a very good understanding of how belief works. The real trick wasn’t inventing fake customers. It was convincing everyone that no one needed to check.