Speaking to ET Now, Anurag Singh, Managing Partner, Ansid Capital said there are no immediate red flags for US equities, even as headline indices may not deliver outsized gains in the coming year.

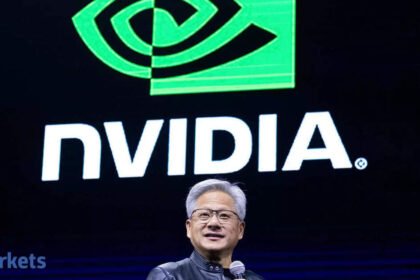

“There are no signs of trouble as such for the US market. Now, projections vary from 7,000 to 7,400 by the end of 2026 next year, so which means that market expects that there is not a significant upside at least on the index level, but at the same time the real action lies beneath the index,” he noted.Singh pointed out that the much-loved AI trade has begun to attract healthy scepticism, particularly around the return on massive data centre investments. “This whole AI trade is now beginning to falter a bit which is that people are beginning to question whether this investments into data centre are going to give the ROI that the markets are projecting,” he said, citing sharp corrections across several marquee names. “Oracle… saw a 50% correction believe it or not. Broadcom saw nearly about 35-40% correction. Nvidia is 15% down.”

He added that such pullbacks are not necessarily negative. “It is a very healthy scepticism which is fine. We do not want to get into a bubble.” Beyond AI, Singh highlighted strong support from broader policy pillars in the US. “Look at how beautifully the other two pillars of the Trump administration are working out. One is taxes, low taxes… And the next is deregulation,” he said, adding that GDP growth of around 3% underscores the economy’s strength. “Overall, no signs of trouble, markets are looking fine… overall market is pretty stable, robust.”

On India, the discussion turned to whether a faltering US AI trade could redirect flows towards Indian IT services. Singh remained cautious on valuations. “When those are the questions being raised, there is always going to be a question about how much these IT services should be worth. Should they be above 30 price earning multiple? I seriously doubt that,” he said. While business growth may remain steady, he flagged valuation risks. “I know TCS hit almost like more than 40 PE, that is not warranted.” He expects stable top-line growth of 4–5%, but added, “they have this existential threat constantly on their head which means that their multiple should also correct to kind of 20 or something closer to that number.”

Asked whether recent corrections in AI-linked stocks offer a buying opportunity, Singh differentiated sharply between business models. “Let us divide this into hyperscalers and everybody else,” he said, reiterating his scepticism on Nvidia. “After all it is a hardware company and the moment it is just one innovation away from a disaster. I doubt whether it can continue to maintain a 75% gross margin monopoly.”

In contrast, he expressed comfort with platform-driven giants. “I am pretty optimistic on these Googles of the world and Metas of the world and Amazons because they are deploying artificial intelligence,” he said, citing Microsoft’s recent price hikes as evidence of monetisation power. “To answer your question, you can buy the dip in the companies where the revenues are steady and stable.”

Turning back to India’s market segments, Singh reiterated his long-standing preference for large caps and warned that mean reversion is still at play in mid- and small-cap stocks. Drawing on long-term data, he said, “From 1994 till 2019 the Nifty had a returns of 12%… but Nifty 500 had returns of 11%,” underscoring that broader markets have historically underperformed. The post-2020 surge, in his view, is moderating. “There is more moderation to go, ultimately mean reversion is the ultimate truth in the market.”

He concluded by explaining his cautious stance. “I have always been a big fan of largecap in India… my allocation to India would be expecting a 10-12% stable return which I largely get in largecap,” Singh said, adding that identifying mid- and small-cap opportunities requires deep local engagement. “For me that natural market is United States that is not India for me, so that is kind of where my scepticism comes from.”