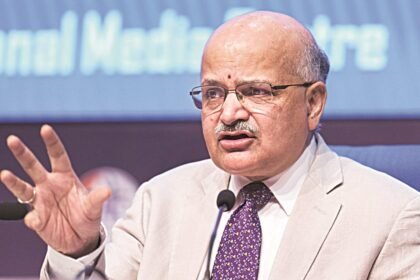

According to market expert Ajay Bagga, three crucial triggers have been driving this momentum. First, the brief handshake and exchange between Prime Minister Modi and President Trump have sparked hopes of potential tariff concessions, which could ease trade tensions.

Second, the recent GST cut has boosted consumption-related sectors and banking stocks, fueling market confidence.

“Third is the earnings bottoming out. So, we have seen downgrades to earnings bottoming out in the June quarter and we are expecting that from here on, from the September quarter earnings season onwards we will see better earnings,” Bagga said.

Globally, liquidity conditions remain highly supportive, with nearly $184 trillion in financial liquidity circulating—an all-time high—benefiting risk assets across asset classes from equities to gold and crypto. Additionally, the US Federal Reserve is expected to cut interest rates in a non-recessionary backdrop.

Bagga noted that historically, such cuts during growth phases have supported US equities for the following year, which in turn bolsters global markets. He emphasized that this is not a rescue measure for a weak economy but rather an adjustment within strong economic growth, making it a very constructive move. The IT sector staged its strongest weekly rally since May 2025, signalling a revival of investor confidence after a prolonged period of underperformance. Bagga believes the sector remains underappreciated and underinvested, despite being poised for a significant role in the next phase of the artificial intelligence revolution.“So, it has been the infrastructure creators of AI which has benefited more. We have seen the AI software providers getting huge valuations,” he said.

However, the third critical leg, end-user adoption, has yet to fully take shape. This is where Indian IT companies are expected to shine, by acting as service providers that customise AI solutions for businesses across industries.

Markets, being forward-looking, are already beginning to price in this opportunity. The groundwork for AI deployment is in place, and the next stage involves tailoring solutions to improve revenue, productivity, and profitability at the enterprise level.

“It can be as big as the Y2K opportunity that has not come to fruition so far, so that has been a disappointment over the last one year. We were expecting it to hit earlier, but now we are quite confident that it is coming. We are at the incipient zone for it and it should do well from here on,” Bagga said.

The defence sector in India is shaping up as a strong long-term growth story, backed by rising domestic demand, import substitution, and expanding export opportunities. According to Bagga, this is a “multi-decade story” with India possessing the technical expertise and cost advantage to build competitive weaponry. Recent order announcements have triggered sharp rallies, with some frontline defence stocks gaining up to 8% in a single session.

However, valuations remain a challenge. The sector often witnesses sharp run-ups followed by phases of profit-booking, leading to short-term volatility. Despite this, the fundamental runway is robust, supported by continuous government focus, rising self-reliance in defence manufacturing, and global opportunities.

Bagga compares India’s trajectory to China’s rise in defence capabilities since 2000, highlighting the potential scale of growth. Investors, therefore, need patience—holding through cycles of rallies and corrections—as long-term prospects remain highly attractive for wealth creation.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source