The private wealth management arms of 360 One and Centrum Wealth are in discussions to facilitate secondary deals amounting to Rs 300–350 crore in the jewellery retailer BlueStone, said people in the know. Both platforms will sell the stakes to their clients ahead of the Bengaluru-based company’s public market debut, they said.

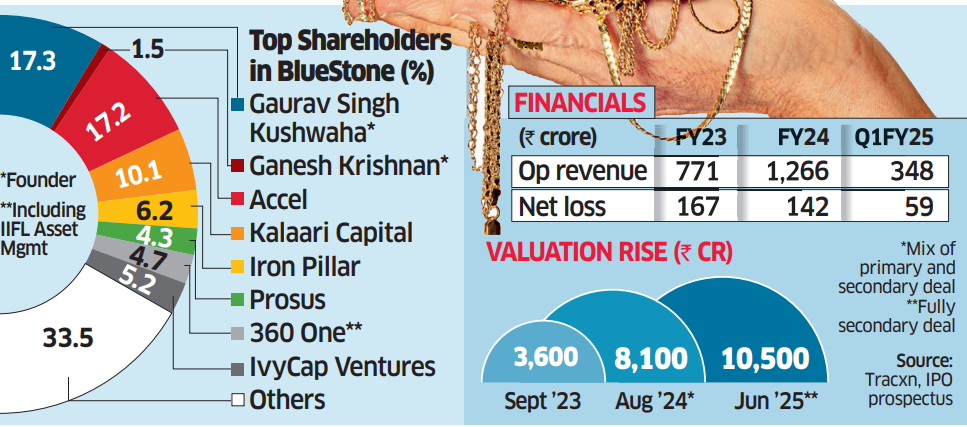

The transaction will value BlueStone at Rs 10,500 crore ($1.2 billion), about 30% higher than its Rs 8,100 crore valuation from the last funding round in August 2024.

According to one of the people in the know, Singapore-based RB Investments will fully exit BlueStone through the deals. RB Investments, which holds a 2–3% stake in the company, is set to make a 10–12x return on its investment. It backed BlueStone across various stages between 2016 and 2019, investing around Rs 28–30 crore. The Singapore-based family office has also backed Indian companies such as Swiggy, Giva and Rebel Foods.

“The round took place because there was interest from certain investor classes to pick a stake prior to the IPO,” one of the persons said. “BlueStone is soon expected to finalise the pricing for the IPO.” A secondary deal is between existing and incoming investors, and the cash doesn’t go into the company.

Wealth managers pool investment deals for their clients, which typically include the likes of domestic family offices and high networth individuals (HNIs). These investors are usually added to the capitalisation table prior to a public issue.

Private wealth management firms have earlier facilitated pre-IPO deals in companies such as food and grocery delivery firm Swiggy, hospitality platform Oyo, logistics startup Shadowfax and business-to-business (B2B) meat company Captain Fresh.

BlueStone filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (Sebi) in December, gaining approval in April. Its IPO includes a fresh capital raise of Rs 1,000 crore and an offer-for-sale (OFS) component of nearly 24 million shares, which will see investors including Accel, Saama Capital, IvyCap Ventures and Kalaari Capital selling their stakes.

Queries sent to BlueStone founder and CEO Gaurav Singh Kushwaha went unanswered. In response to an emailed query, Centrum Wealth said, “There may be a few HNI clients who seek exposure, to whom we may facilitate through a market intermediary.”

A spokesperson for 360 One said, “We have no comments on the query.”

RB Investments also did not respond.

BlueStone had closed a Rs 900-crore funding round—a combination of primary and secondary transactions—in August 2024, which saw the participation of investors such as Peak XV Partners, Prosus, Steadview Capital, Think Investments and Infosys cofounder Kris Gopalakrishnan’s family investment office Pratithi Investments.

In May this year, BlueStone raised Rs 40 crore in debt from alternative debt platform BlackSoil and Caspian Impact Investments.

Over the last few years, investors have turned bullish on the jewellery business. This trend picked up steam after the Tata Group’s full acquisition of CaratLane at a valuation of Rs 17,000 crore. The conglomerate had first invested in the startup in 2016, when it was valued at Rs 563 crore.

Omnichannel jewellery startup Giva, which specialises in silver products, is also in talks to pick up Rs 450 crore ($53 million) in a financing round led by Creaegis in addition to participation by Premji Invest, Epiq Capital and others.

BlueStone closed fiscal 2024 with Rs 1,266 crore in revenue, a 64% jump from the year ago. Its loss during the year contracted to Rs 142 crore in FY24 from Rs 167 crore in fiscal 2023. For the first three months of fiscal 2025, BlueStone reported operating revenue of Rs 348 crore and net loss of Rs 59 crore.