The power and infrastructure stock has been on a tear this year, gaining 34.3% in 2025 so far and up 31.5% over the last 12 months. Longer-term returns are even more staggering, with the stock rising 302.2% in the past two years and delivering an eye-watering 1183% return over the last five years.

Bullish charts, overbought signals

From a technical perspective, JP Power is currently trading above all its eight key simple moving averages (SMAs), spanning the 5-day to 200-day markers, suggesting robust bullish sentiment across timeframes.Momentum indicators also point to sustained strength. The Relative Strength Index (RSI) stands at an elevated 84.3, a level widely viewed as strongly overbought, which implies that stock may show pullback in the near term.

At the same time, the Moving Average Convergence Divergence (MACD) is at 1.7, comfortably above both the signal and center lines, reinforcing the prevailing uptrend.

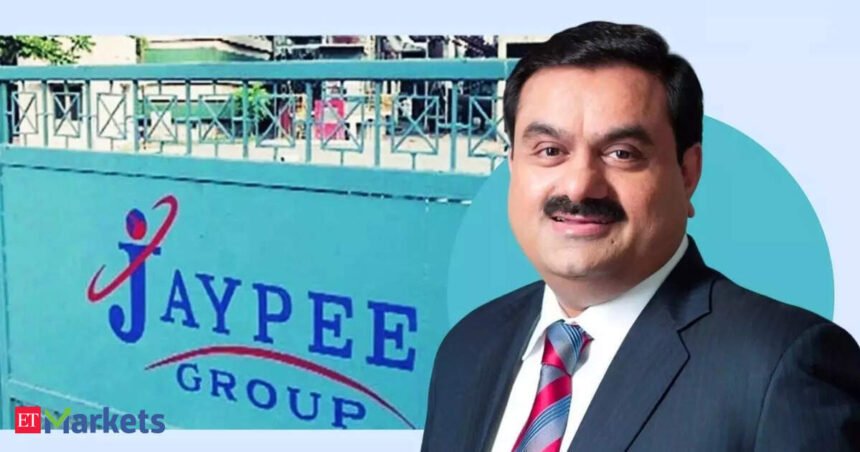

Adani buzz and resolution hopes

The rally last week was largely sparked by reports that the Adani Group had submitted a bid to acquire the debt-laden Jaiprakash Associates, a company linked to JP Power via a corporate guarantee on a $150 million external commercial borrowing, later converted into a rupee loan.JP Associates is undergoing insolvency resolution, and has reportedly attracted six bidders: Adani, Vedanta, JSPL, Suraksha Group, Dalmia Bharat, and PNC Infratech. The proposals are understood to be for acquiring the company in full. The strategic implications of the resolution process have brought JP Power into sharp focus, fueling both price and volume action in recent sessions.

Analyst view: Key levels and caution

According to Kunal Kamble, Sr. Technical Research Analyst at Bonanza Portfolio, JP Power has broken out of a 17-month consolidation zone, supported by rising volume that reflects increased buyer interest.

Kamble noted that the stock is nearing a crucial resistance at Rs 24, and a decisive close above this level could unlock stronger upside momentum.

The stock’s position above key exponential moving averages reflects bullish sentiment, with the recovering monthly RSI indicating renewed strength, Kamble noted, adding that the overall setup suggests strong accumulation. From a trading perspective, he sees scope for fresh entries above Rs 24, with a stop-loss at Rs 17. If momentum holds, the stock could potentially climb to the Rs 38–45 range over the medium term.

Also read | Sensex falls over 300 pts, Nifty below 25,100 on weakness in IT and financial stocks

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)