Omnichannel eyewear retailer Lenskart is likely to issue additional shares to its founder and CEO Peyush Bansal through a structured payout arrangement, which could increase his stake in the public markets-bound company by 1.5-2%, said people briefed on the development.

Bansal and his wife Neha Bansal, also a cofounder, currently hold a combined stake of about 12-13% in the firm.

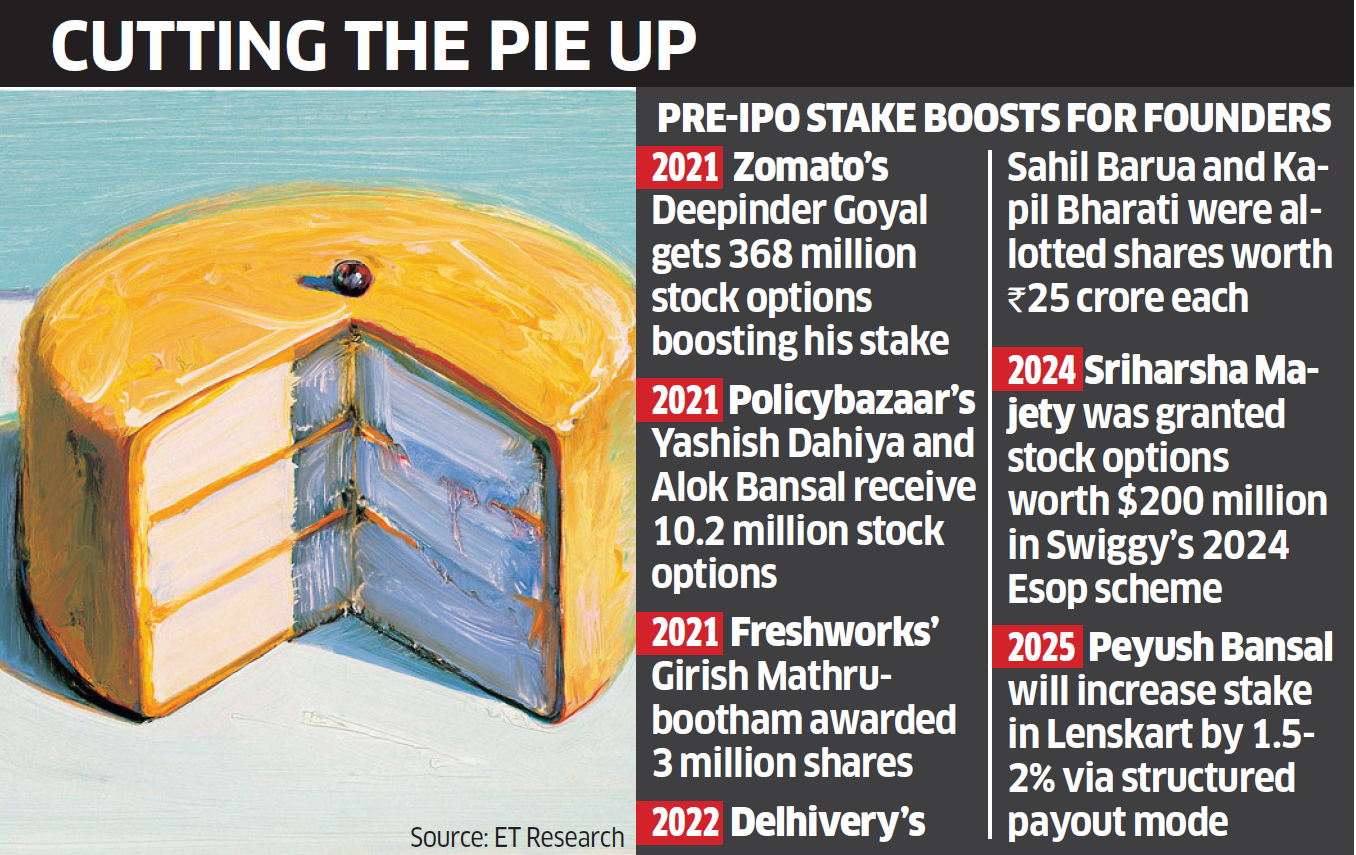

The move reflects a broader trend among consumer tech and internet companies, such as Zomato (now Eternal), Swiggy, Delhivery, PB Fintech and Freshworks, which have awarded stock to founders ahead of their initial public offerings (IPOs) through various mechanisms.

“The transaction is yet to be finalised but Bansal is likely to be allotted shares at a fair market value as determined by the bankers and the auditors. This will result in his stake going up by roughly 1.5–2%,” said one of the persons, who did not wish to be identified.

In June 2024, the Bansals along with founders Amit Choudhary and Sumeet Kapahi had invested around $20 million in the company.

Industry executives said that for companies raising significant capital, founder stakes often get diluted, and that pre-IPO stock grants serve as a way to compensate and retain them.

“It’s quite common for founders to increase their stake ahead of an IPO… They see the upside and approach the board, citing their low shareholding. When a founder’s stake drops significantly, boards often accommodate by allocating shares through expanded Esop (equity stock ownership plan) pools or other mechanisms,” said Anshuman Das, CEO of executive staffing firm Longhouse.

This is facilitated through increasing the Esop pool, buying out an existing investor or preferential allotments, Das said, adding, “In large consumer tech or internet firms, heavy fundraising often leads to substantial dilution of founder equity.”

Such a practice is common among new-age, venture-backed companies where founders often see greater dilution, unlike in traditional businesses where promoters retain a larger shareholding.

IPOs are milestone events for investors and boards tend to be more open to rewarding founders for steering the company to that point, as they should also benefit from the value created. In larger companies, where promoters hold a bigger stake, that upside comes through post-IPO share gains, said another industry executive.

Queries sent to Lenskart did not elicit a response till press time.

Rewarding founders

Food and grocery delivery company Swiggy had granted employee stock options worth around $271 million to its top management in its latest stock-based compensation plan implemented in April last year. Around $200 million worth of options from this were granted to founder and group CEO Sriharsha Majety. Swiggy listed on the bourses in November 2024.

Prior to this, in 2021, Zomato’s board granted founder and CEO Deepinder Goyal 368 million stock options with a six-year exercise window that could effectively double his stake in the company from nearly 4% at present.

Other tech startups, such as Freshworks, Delhivery and PB Fintech, that went public after Zomato also granted stock-based awards to their founders and top management prior to their IPOs, particularly in cases where founder stakes were under 10%. These executives include Freshworks founder and then CEO Girish Mathrubootham, Delhivery founder and CEO Sahil Barua and PB Fintech founders Yashish Dahiya and Alok Bansal.

Delhivery’s cofounders Sahil Barua and Kapil Bharati along with other senior executives at the time were allotted shares worth Rs 25 crore each. Similarly, prior to the company’s 2021 IPO, Policybazaar parent PB Fintech had granted 10.2 million shares to founders Dahiya and Bansal as part of its 2021 Esop scheme that was announced ahead of its public issue.

Lenskart plans to file its draft IPO papers this year, targeting a potential $10 billion valuation for a $1 billion public issue, ET had reported earlier.

One of the persons said that the company has been meeting public market investors and that the IPO size and valuation will be finalised depending on broader market conditions.

Lenskart’s last round of funding in June 2024 valued the company at $5 billion. US-based Fidelity marked up the valuation of the omnichannel eyewear retailer by more than a fifth to $6.1 billion at the end of April 30.

In 2023-24, the Gurgaon-based company’s net loss shrank to Rs 10 crore from Rs 64 crore in the previous financial year, which the company attributed to technology-driven operational efficiencies. Operating revenue increased 43% to Rs 5,428 crore, while earnings before interest, taxes, depreciation and amortisation more than doubled to Rs 856 crore.