Fine, but it’s easy to forget that it took more than eight years for Amazon’s stock price to return to its March 1999 pre-crash level. And then there’s Cisco Systems Inc., whose journey was even more arduous: Its post-dot-com crash recovery was finally completed on Monday.

Bloomberg

BloombergIt’s comparisons like this, to 1999 and the misery that ensued, that have dampened Nvidia Corp. in recent days. Its stock is down more than 7% over the past seven days despite expectations of another extraordinary quarterly earnings report on Wednesday.

The leading AI chipmaker is expected to post 57% year-on-year revenue growth. Forecasts point to fiscal 2026 revenue hitting a staggering $208 billion. The ramp-up of production for its next-generation of hardware is said to be on track. But with the door to selling top chips to China now seemingly shut, cutting short what would have been a strong growth area, the fear is that we have reached peak Nvidia: The AI boom and associated infrastructure spending have been priced in and, with talk of 1999 in the air, the only way is down.

Bloomberg

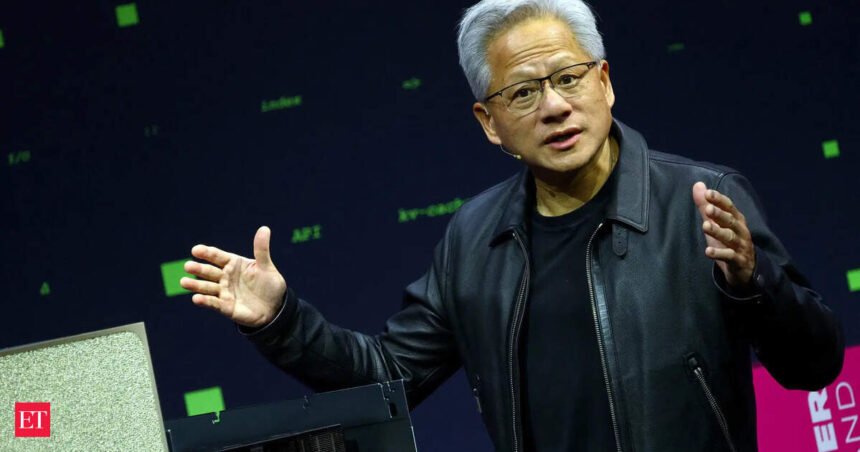

Bloomberg“I don’t believe we’re in an AI bubble,” Chief Executive Officer Jensen Huang told Bloomberg last month, bucking the prevailing mood, even among AI’s biggest fans. But the backdrop for this talk has been some recent headline-making exits. Last week, SoftBank Group Corp. pulled its entire $5.8 billion Nvidia holding for reasons it said had “nothing to do with Nvidia itself” but was about freeing up money so it could funnel more of it toward backing OpenAI, which is burning an unprecedented amount of cash in the questionable pursuit of superintelligence.

On Monday, Peter Thiel’s hedge fund disclosed in a filing that it had sold its entire Nvidia stake, worth around $100 million. The move was in line with Thiel’s comments about AI on a New York Times podcast earlier this year. “It’s more than a nothing burger,” he said, but “less than the total transformation of our society.”Other warning signs come from companies like CoreWeave Inc., the pure-play AI data center company I’ve warned will be a reality check on the AI business. Its stock has slumped more than 40% over the past 30 days because of weak margins and lowered guidance. Critically for Nvidia, CoreWeave is finding it difficult to build the data centers required for the next industrial revolution despite the tidal wave of spending commitments — numbers so large they are starting to lose all meaning. “Does it even matter if you keep counting after you get to $1 trillion of capital expenditure in the next couple of years? asked Marc Lipshultz, co-founder of Blue Owl Capital, which is financing many of the biggest infrastructure deals.Last year, Thiel predicted 2024 would be the new 1999. Clearly he was either wrong or early. If history repeats itself, 2026 might be the hangover investors have been fearing — the onset of a slump that might take an extended period to recover from, even if AI does end up being as transformative as people predict. “We can look back at the internet right now,” Alphabet CEO Sundar Pichai said in a BBC interview on Tuesday. “There was clearly a lot of excess investment, but none of us would question whether the internet was profound, or did it drive a lot of impact. It’s fundamentally changed how we work digitally as a society. I expect AI to be the same.”

Nvidia is clearly no Pets.com. But some of its clients might well be, and their fortunes are inextricably linked, whether through sentiment or actual financial ties.

On Tuesday came news of yet another circular AI deal, with Nvidia investing $10 billion in Anthropic, which in turn said it would pay Microsoft Corp. for access to Nvidia chips. Some have defended Nvidia’s investment strategy as a smart diversification, reducing its reliance on the handful of biggest hyperscalers or on individual startups like OpenAI. But what Huang can’t do is hedge against falling confidence in AI more broadly, which is what he and his company face now and into the new year.