New Delhi: Titan Company is “pushing the boundaries of price” for its flagship watch business, with the base price moving up to ₹3,000 per watch, from about ₹2,000 within two years, said managing director CK Venkataraman in an interview. “Premiumisation has now reached deep; customers are buying a ₹50,000 watch even in small markets like Satna or Katni. If you look at every research study, they point to a rising share of income classes in the country…See the homes that are being advertised, the cars that are being advertised-you can see it there,” he said.

Consumer categories across India have been exhibiting divergent growth trends, with rising sales of premium goods across watches, smartphones, apparel, and cars compared to last year, even as demand in mid-segment categories remains muted as high inflation leads consumers to defer discretionary spending.

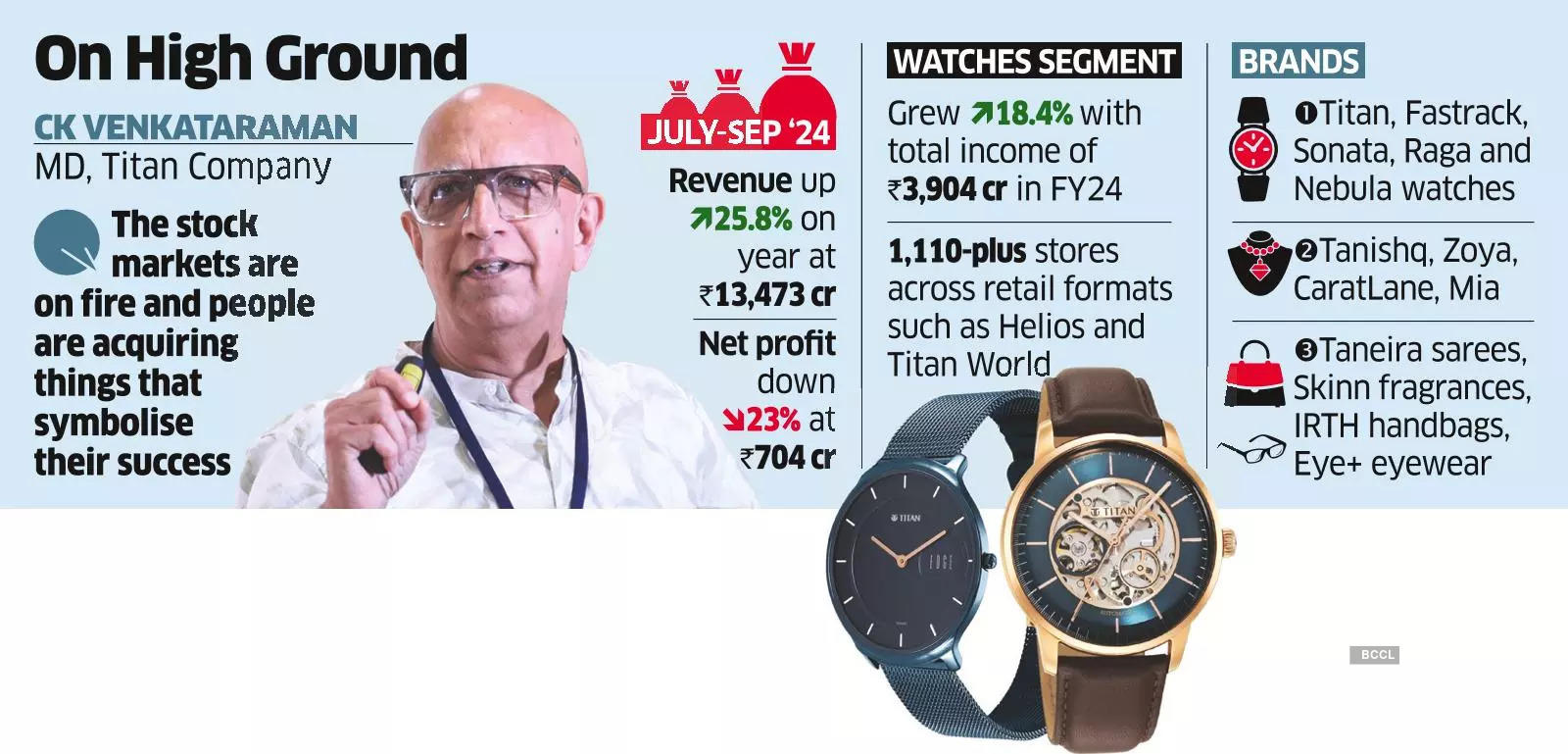

Titan reported 23% drop in net profit from a year earlier in the September quarter at ₹704 crore. Profit took a toll from the jewellery business, which was impacted by a customs duty cut, leading the company to sell existing stocks at lower market prices. Revenue grew 26% year-on-year in the quarter to ₹13,473 crore.

Titan, which began as a watchmaker in 1984, also sells jewellery brands like Tanishq, and Taneira sarees, and Eye+ eyewear.

The company’s watches and wearables division, which includes Titan and Fastrack brands, reported 19% year-on-year rise in total income at ₹1,301 crore in the September quarter. “The stock markets are on fire and people are acquiring things that symbolise their success,” Venkataraman said. The company’s wearables segment includes Titan Smart and Fastrack smartwatches, fitness trackers and smart rings which track health metrics such as body movement and sleep.

A joint venture between Tata Sons and Tamil Nadu government’s TIDCO, Titan operates over 1,110 stores across retail formats such as Helios and Titan World and SF. “We are there in the smallest of towns, not just in the malls. We are in the typical markets of Faridabad or Ballabgarh,” Venkataraman said.

Market researcher IMARC has forecast the Indian watch market to grow to $10.2 billion by 2033 from $6.4 billion in 2024. “Increasing investment in marketing by watch manufacturers to build their brand image along with innovation and the launch of customised watches represent some of the key factors driving the market,” it said in a report.

The less than ₹5,000 mass watch segment is estimated at 30% of the market, while the fashion segment of ₹5,000-₹25,000 contributes nearly 21%.

However, the premium and luxury segment is the largest driver of growth, contributing about 49% to the overall category.

In the domestic market, watches contributed 8% to Titan’s overall sales of ₹47,624 crore in FY24.