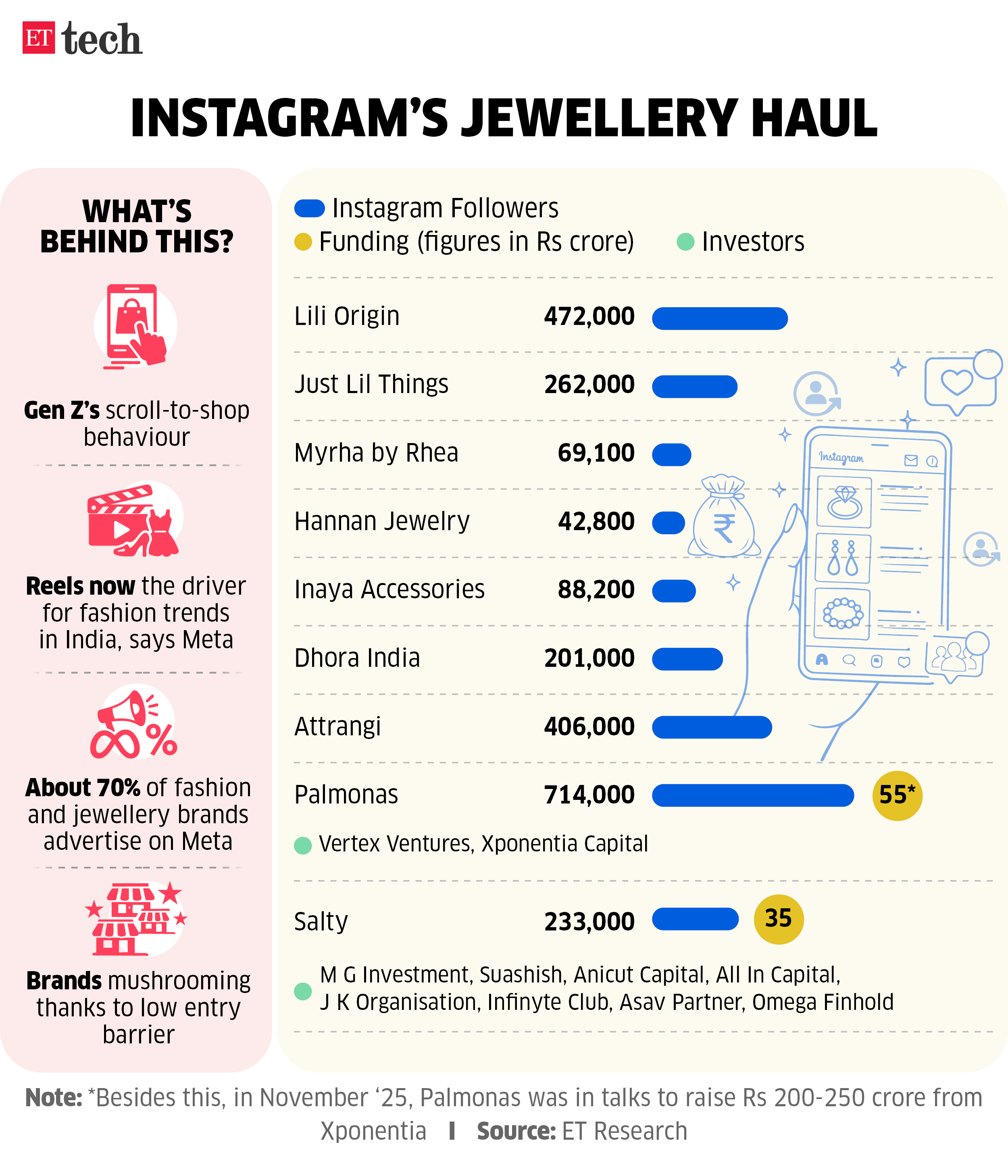

A fashion jewellery market is emerging on Instagram, driven by reels, styling videos and user-generated posts on the Meta-owned social media platform that connect instantly with digital native shoppers. Brands such as Lili Origin, Attrangi, Dhora India, Just Lil Things and Hannan, which have come up over the past few years, have helped bridge the gap between browsing and buying, with third-party logistics players acting as key enablers, according to industry executives.

“Several brands indicate that customer acquisition costs on Instagram are often lower than on Google, particularly since discovery is driven organically rather than through ads,” said Abhishek Bansal, cofounder and chief executive at the new-age logistics startup Shadowfax.

He added that video commerce is becoming one of India’s strongest growth levers, as consumption of Instagram Reels rises and shopping becomes discovery-led.

The flood of supply has intensified competition, making product differentiation increasingly difficult. It has also encouraged aggressive discounting strategies, such as bundles, and “buy more, get more” offers.

While the trend is not restricted to jewellery—with categories such as make-up, fashion, accessories and home decor also finding their way into Instagram’s shopping section—fashion jewellery stands out owing to the rapid growth of brands despite offering nearly identical designs. Experts attribute this to low barriers to entry into the segment.

“Reels is now the launchpad for fashion trends in India, with engagement on fashion and style content 40% higher on Reels than other platforms,” said Meghna Apparao, director – ecommerce and retail, Meta (India). “To address these evolving behaviours, we launched omnichannel ads last year, enabling advertisers to highlight nearby store locations to people most likely to shop in person.”

Scroll-to-shop: The new normal

For many Gen Z shoppers in their early 20s, shopping via a social media ad while scrolling through the feed feels most natural, with impulse purchases offering both retail therapy and instant gratification. “Things like make-up, fashion jewellery or reasonably priced apparel are impulse purchase items. While the user is just scrolling on Instagram and likes a post, they immediately visit the website and place the order since the price is low,” said Pallavi Mohadikar, chief executive, Palmonas.

The jewellery brand, which retails 17- and 18-carat gold-plated items, records about 65-70% of its traffic from paid marketing campaigns on Instagram.

“Brands know that the open rate on Instagram is higher compared to any other shopping app on a user’s phone,” said Renu Bisht, founder of direct-to-consumer brand consulting firm Commercify360. “When brands look at advertising on Meta, they think of Instagram as the primary platform. In the Meta universe, most of the interaction happens on Instagram for anyone above 22 years.”

According to Bisht, about 70% of a fashion or jewellery brand’s marketing communications spend goes towards ads on Meta, with the rest being divided between Google and ecommerce.

Low (or no) entry barrier

“The entry barrier is very, very low and that’s why you see a lot of Instagram sellers popping up,” said Mohadikar. “People who understand the market, the customer, the insights, and build on it, become big.”

Aavriti R Jain, founder of Dhora, said, “While the platform has enabled rapid brand creation and organic scale, it has also opened the door to China-sourced goods offered by discount-heavy players, leading to commodification, copies and even fraud.”

The result is near-identical products, with consumers increasingly struggling to tell one brand from another, making price and posting frequency often matter more than originality.

“Even if you decide tomorrow, you can source, launch a brand and start selling instantly online,” said Rishi Baweja, cofounder, Hannan.

The popular brands are trying hard to stand out from competitors.

“What separates winners from the rest is execution,” said Vidhushi Jain, founder of Attrangi, which started as an Instagram store in 2018. “Consistent posting, sharp merchandising, frequent catalogue refreshes and well-packaged offers have become central to growth.”

Attrangi, which booked revenue of Rs 24 crore for 2024-25, expects growth to come from new stores in Delhi and Dubai, along with a larger boutique in Delhi.