Mumbai: Shares of Trent, Tata Group’s retail chain, plunged over 8% on Tuesday-the steepest single-day decline in six months-after the company’s third quarter business update disappointed investors. Analysts said investors could cut exposure to the stock as the current earnings growth does not justify the rich valuations.

The stock slumped 8.5% to close at ₹4,055 on Tuesday, eroding the company’s market cap by over ₹13,500 crore. “The Street was anticipating a high double-digit revenue growth rate, which Trent failed to deliver, and the steep valuations are also a concern,” said Vyom Chheda, research analyst, StoxBox. “Currently, the stock is trading at around 90 times price to earnings.”

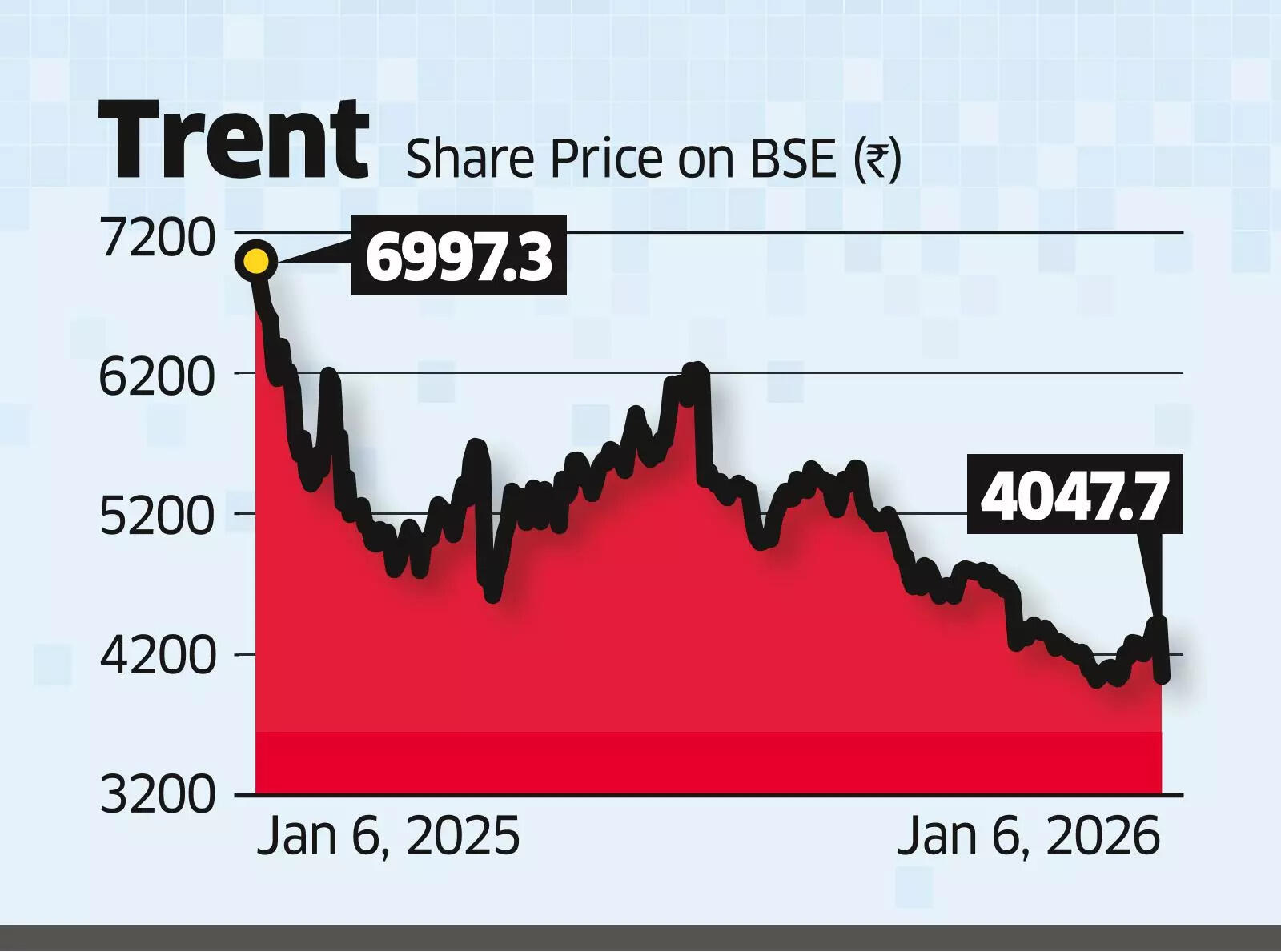

Trent, a market darling during the bull run until September 2024, skyrocketed nearly 1,700% in less than five years from its March 2020 lows. Since October 2024, the stock has been on a downward slide, shedding 40% in 2025 as against the near 11% upmove in the Nifty. Analysts said slowing growth expectations are weighing on the stock. Chheda said that the company is growing at 17% year on year, which is quite low because of economic slowdown and densification.

At the same time, its valuations remain rich. Trent continues to trade at a rich multiple of about 70-75 times price to earnings, said Dharmesh Kant, head of research, Cholamandalam Securities.

“The best is behind Trent as the best probable growth rate is expected to hit a ceiling of 25% and the stock is likely to witness time-wise corrections,” said Kant. “Investors can book profits as Trent is not expected to offer any meaningful money-making opportunities in the next two years.”

Chheda also recommends selling unless earnings flash a revival in growth.

The weakness in Trent’s shares rubbed off on other retail chains on Tuesday. V2 Retail’s shares tumbled close to 4% while Aditya Birla Lifestyle Brands and Shoppers Stop fell over 2% each. Avenue Supermarts and Aditya Birla Fashion and Retail, however, rose 0.7% and 0.3%, respectively.

Analysts said the growth is slowing down across merchandise retailers. “Resuming growth of 25% from the current 17% could be a Herculean task for the company as it has already undergone significant store expansion and penetration across cities,” said Kant. Brokerage Motilal Oswal said Trent’s stock price had run up in the last few days (up 9% since December 19) on expectations of a pick-up in revenue growth. “A weaker-than-expected number could weigh on recent stock price recovery as earnings downgrades are likely to continue in near term,” said analysts at the brokerage.