Global private equity firm Warburg Pincus is in discussions with Kalyan Jewellers India to acquire about 10% stake in the Kerala-based company’s lifestyle brand Candere for Rs 800-850 crore, two people aware of the discussions told ET.

The New York-based growth investor will likely purchase part of this stake from Kalyan Jewellers, while the rest will be newly issued shares in Candere, one of the people said. Candere will use the proceeds from newly issued shares to expand its presence, he said.

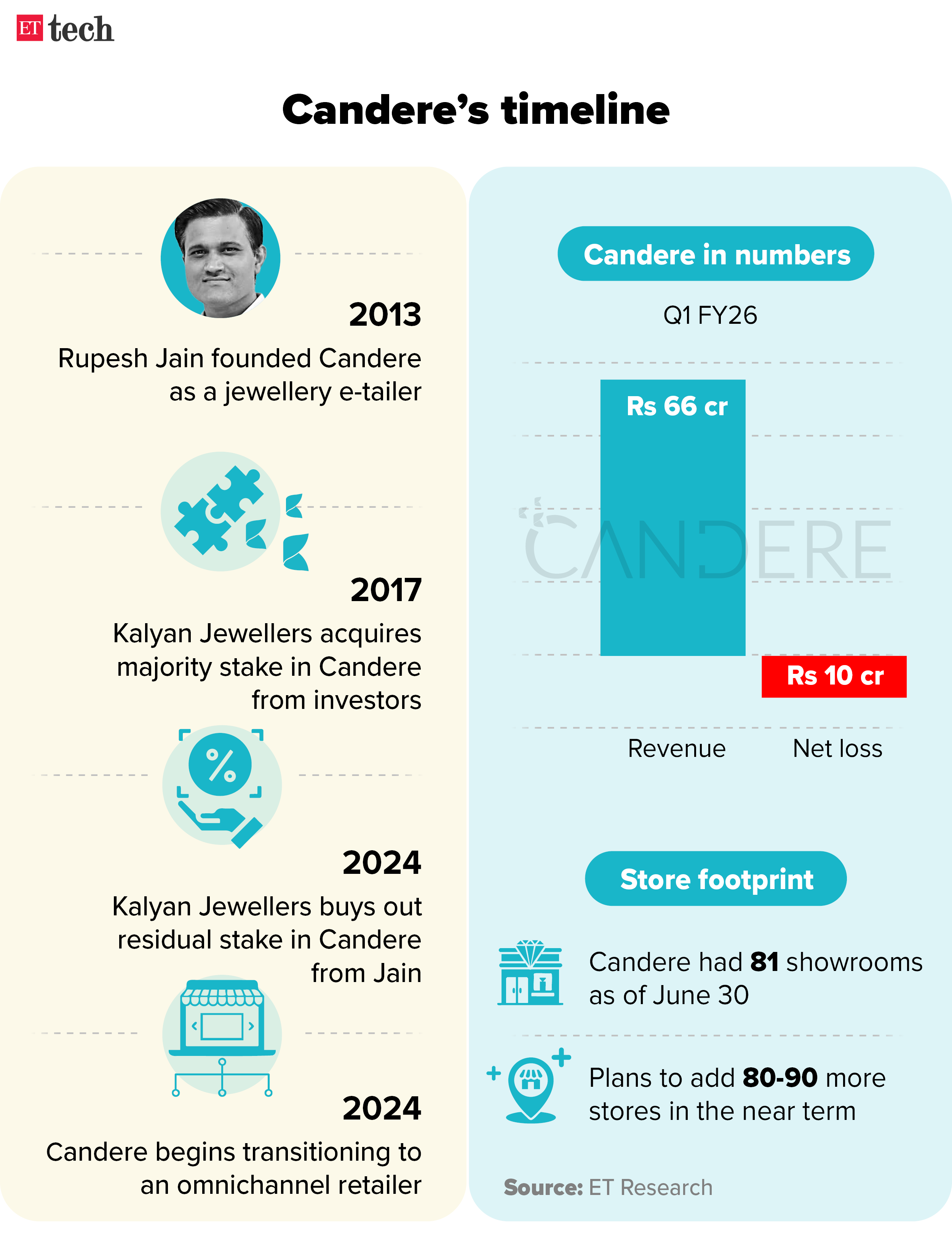

“Kalyan Jewellers is in the process of rapidly expanding its store footprint…this includes an addition of around 80-90 Candere stores, which it is setting up across the country through a franchise-led model,” the person said.

For Warburg Pincus, an investment in Candere would mark a return to the Kalyan Jewellers group as an investor. The fund, which had been an investor in Kalyan Jewellers since 2014, fully exited the listed company last year.

Kalyan Jewellers did not respond to ET’s queries. Warburg Pincus declined to comment.

Kalyan Jewellers shares ended 0.26% lower at Rs 508.50 on the BSE Tuesday.

The jewellery retail space — particularly the lifestyle and lab-grown diamonds sections — has seen several deals in the recent past. These include direct-to-consumer jewellery startup Giva getting a Rs 530-crore investment from Creaegis, PremjiInvest, Epiq Capital and Edelweiss Discovery Fund, lab-grown diamond maker Aukera raising $15 million from Peak XV Partners and others, and the public market listing of BlueStone after a Rs 1,540 crore initial public offering.

Aggressive expansion

Kalyan Jewellers has been aggressively expanding Candere amid increasing demand for jewellery items that are branded, trendy and affordable, even as the broader industry sees headwinds from volatile gold prices.

The valuation of Candere, founded in 2013 as an online jewellery retailer, has grown manifold since Kalyan Jewellers acquired an 85% stake in 2017 from Singularity Strategic, the family office of Brijesh Chandwani and Subram Kapoor, for Rs 35–40 crore. In 2024, it bought out the remaining 15% from founder Rupesh Jain, transitioning Candere from an online-only platform into an omnichannel retailer.

“Over the last 12 to 18 months, we have been giving shape to our plans to expand the distribution network beyond the mainstream Kalyan Jewellers,” Kalyan Jewellers executive director Ramesh Kalyanaraman said during the company’s quarterly earnings call on August 7. “Candere was identified as a second format with predominant focus on lightweight lifestyle jewellery…and we added more than 70 Candere showrooms in the last 18 months,” he said.

For the last quarter ended June 30, Candere recorded revenue of Rs 66 crore, up 67% from a year earlier, even as net loss widened to Rs 10 crore from Rs 2 crore. The company’s management, however, indicated that the brand would achieve profitability by the end of this financial year ending March 31, 2026.

Kalyan Jewellers posted consolidated revenue of Rs 7,268 crore for the quarter, up around 31% from a year earlier, despite multiple pauses in demand during the quarter, primarily due to volatility in gold prices and geopolitical tensions. Its net profit for the quarter rose 48% to Rs 264 crore.

Also Read: Kalyan Jewellers Q1 PAT jumps 49% YoY to Rs 264 crore, revenue grows 31%

Warburg Pincus exited Kalyan Jewellers in August 2024 by selling a 2.36% stake to promoter TS Kalyanaraman and the remaining 6.81% via a block deal. The private equity firm held an around 30% stake in the jewellery retailer before it sold part of it in the 2021 IPO.

Warburg Pincus first backed Kalyan Jewellers in 2014, investing Rs 1,200 crore. It was followed by another Rs 500 crore investment in 2017.